The EB-5 immigrant investor program offers a unique way for foreign nationals to get U.S. permanent residency. The program is a straightforward, stable, transactional proposition offering a green card for significant capital investment in U.S. commercial enterprise. Is the EB-5 program worth it? The answer transcends a simple yes or no and requires a nuanced analysis of direct costs, opportunity costs and intangible benefits of U.S. residency. This article will dive into the financial principles underpinning the EB-5 program and dissect its economic and opportunity cost.

The True Economic Cost of the EB-5 Program

The minimum investment of an EB-5 visa is substantial but only represents one facet of the total economic outlay. A comprehensive financial assessment must incorporate the direct investment and the opportunity cost.

Direct Cost

The most visible cost is the principal investment itself. The Reform and Integrity Act established a two-tiered investment framework:

• Standard TEA Investment: $800,000 for a targeted employment area

• Non-TEA Investment: $1,050,000 for a non-targeted employment area

The lower threshold is designed to direct foreign capital into economically distressed regions like high unemployment and rural areas. Beyond the initial investment, investors must budget for a variety of associated fees which include regional center admin fees (fees can range from $60,000 to $80,000 and are charged by the entity managing the investment).

Opportunity Cost

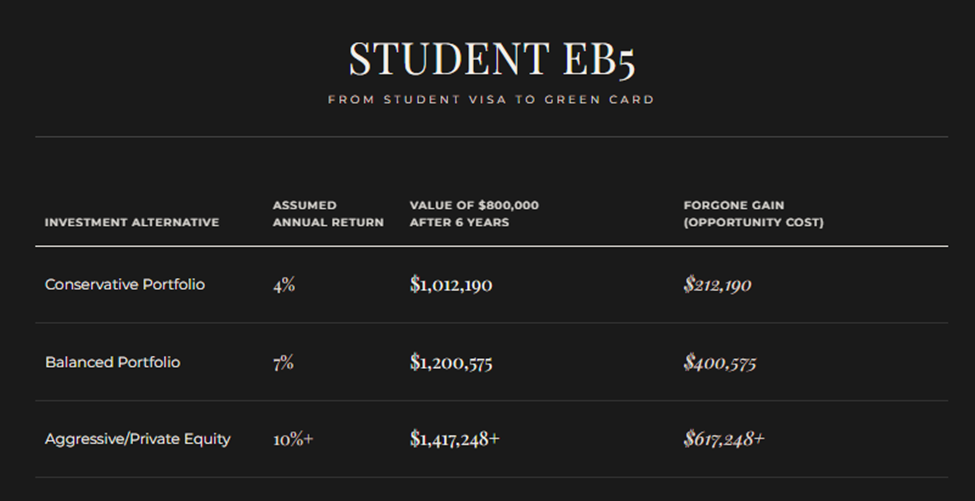

The EB-5 opportunity cost is the return an investor foregoes by placing $800,000 into a low yield EB-5 project for a period of five to seven years instead of deploying that capital in more lucrative ventures. Use our EB-5 Investment Feasibility Calculator to model your specific scenario.

An investment in a balanced portfolio of global equities has historically returned an average of 7-8% annually. Here's a conservative estimate of the opportunity cost for the EB-5 investor:

This places the true economic cost for a family seeking permanent residency through a TEA based project in an average range of $275,000 to $500,000 depending on the investor risk appetite and investment opportunities.

The Value Proposition

The value proposition of the EB-5 program hinges on the perceived worth of its primary benefit. For families facing visa backlogs, job uncertainty, limited opportunities in their home country and have children the value is immense. It provides:

• Stability and peace of mind

• Elimination of anxieties associated with temporary visas

• Access to world-class education for children

• Freedom to work for any employer or start a business

• Path to U.S. citizenship

How to Mitigate Risk?

The analysis above assumes the successful return of the principal investment. The EB-5 program requires that the investment be at risk with no guarantee of return. The failure of the underlying project can lead not only to the loss of capital but also to the denial of the permanent green card if the job creation requirements are not met. The most important task for a prospective EB-5 investor is to conduct thorough due diligence to select a low risk project.

What are the Key Features of a Low-Risk EB-5 Project?

Institutional Quality Developer and Project

The developer's track record is critical to the success of the EB-5 project. Investors should seek out developers with extensive experience in completing projects of similar scale and complexity. The developer should have significant equity invested in the project alongside the EB-5 investor. Learn more about choosing a regional center.

Conservative Capital Stack

The capital stack refers to the layers of financing for a project. A low-risk project will not be overly reliant on EB-5 funds. EB-5 capital should constitute a smaller portion of the total project cost and fill a mezzanine or preferred equity role. The presence of a senior loan from reputable financial institution is strong positive indicator because this means that the lender has already performed their own rigorous due diligence.

Clear and Compliant Job Creation

One of the core requirements of the EB-5 program is the creation of at least 10 full time jobs for U.S. workers per an EB-5 investor. A strong project will have a robust and credible job creation methodology and will typically be verified by an independent economist. Projects that rely on construction related job creation are often considered lower risk than those that depend on specialty operational revenues to meet job quotas. Projects with significant job creation buffers also provide an extra margin of safety for the investor.

Third Party Fund Administration

The Reform and Integrity Act has placed a strong emphasis on transparency and accountability. The use of a third-party fund administrators to oversee the flow of investor funds from escrow to the project is a critical safeguard. The investor is encouraged to due diligence on a regional center's third party fund administrator.

Well Defined Exit Strategy

A reputable project will have a clear and plausible strategy for repaying investors their principal at the end of the investment term. This may involve the sale of an asset or refinancing the asset. Vague or overly optimistic exit strategies should be seen as a red flag for investors.

How the RIA Made EB-5 Investment Opportunities More Attractive

The Reform and Integrity Act has reshaped the landscape of EB-5 investing and has created new categories of projects that are particularly attractive due to preferential treatment by USCIS:

Rural Projects

Rural projects reserve 20% of the annual EB-5 visa quota and these petitions receive priority processing from USCIS which potentially shortens the timeline to residency by over a year. Explore available projects with our TEA Project Explorer. This makes rural projects very attractive for investors.

Infrastructure Projects

Infrastructure projects are given a smaller portion of the total EB-5 visa allocation (2%). The inherent public good and often governmental backing of these infrastructure projects can reduce commercial risk and make them a more secure option than other EB-5 investments.

Conclusion

The EB-5 immigrant investor program is more than a simple financial transaction because it has profound implications for a family's future. The ROI of the EB-5 program is the freedom and flexibility that lawful permanent resident status can give the investor. The reforms introduced by the RIA have provided new tools and incentives that further enhance the attractiveness and efficiency of a well-chosen investment. Overall, a successful EB-5 journey is one that is entered into with a clear understanding of both the costs and the benefits and requires substantial due diligence.

Don't leave your EB-5 investment to chance. Contact StudentEB5 for a free consultation and discover projects with strong fundamentals, experienced developers, and clear exit strategies designed to protect your capital and secure your family's future.