Prospective investors should ask relevant questions to understand the risks involved when investing in an EB-5 deal. This article will explore questions to ask, the ideal answer and the justification behind the question and answer to help investors understand the process of analyzing EB-5 deals. For a complete overview of the EB-5 program, see our Complete 2027 EB-5 Guide. For guidance on choosing a regional center, read our regional center selection guide.

Get the clarity and support you need to navigate EB-5 at StudentEB5.com

1. How many deals have you done?

Ideal Answer: We have successfully managed multiple EB-5 projects and have a high approval rate for I-526 and I-829 petitions across all past projects (minimum 95% or higher). We also have a history of repayment on time and in full.

Justification: The completion and return of investor capital supersedes volume. Investors need to know that the regional center has navigated the entire process from raising funds to obtaining permanent green cards (I-829) and returning capital multiple times to demonstrate a track record of success across all phases of the EB-5 journey.

2. What's the job coverage for this project?

Ideal Answer: We have a job cushion of 30 jobs created per investor. We count construction which is already underway (or close to being complete). The minimum number of jobs required for your Green Card have already been created and will be sustained.

Justification: USCIS requires 10 jobs per investor. If the regional center only projects 10 jobs, then a slight construction delay could cause the investors green card to be denied. A 3 to 1 cushion is usually the industry safety standard.

3. What's the EB-5 project about?

Ideal Answer: EB-5 project is in a rural area and is in a safe business. Construction has already started or is finished for the project and we have a guaranteed maximum price (GMP) contract in place with a reputable contractor.

Justification: We want a boring, stable and predictable project ideally in a rural TEA for priority processing. Ground up construction is preferred because it creates the most jobs per dollar invested compared to operational businesses.

4. What contracts does the project have? What are the risks?

Ideal Answer: The project has a Guaranteed maximum price contract with a major construction firm and a senior construction loan from a major financial institution. The primary risks are typical construction and market risks which are mitigated through the GMP contract and a contingency budget.

Justification: A GMP contract caps costs which prevents budget overruns from stalling the project and killing jobs. A senior loan demonstrates the project has been vetted by other financial institutions and that the construction costs are well defined. A completion guarantee ensures the building gets finished.

5. What is the expected job creation for the EB-5 project?

Ideal Answer: We expect to create 30 jobs per investor strictly through construction expenditure. The job creation is based on a detailed economic analysis prepared by a reputable EB-5 economist and is derived solely from easily verifiable jobs. We expect this number to be higher but the 30 jobs per investor is the most conservative number.

Justification: The job creation methodology should be credible transparent and based on economic analysis. Construction jobs are typically calculated based on money spent which is easy to prove.

6. What's the credit quality for the EB-5 project? Are any funds potentially defaulting?

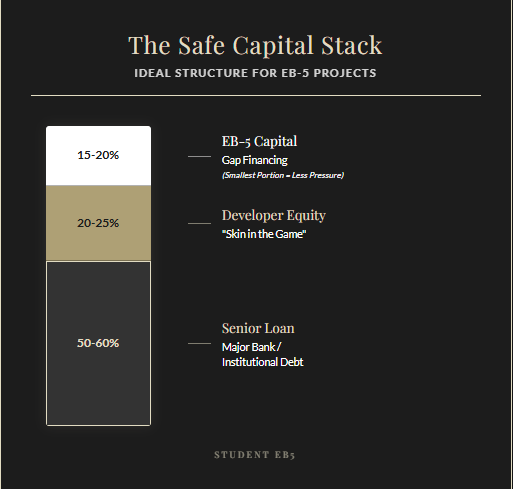

Ideal Answer: The project has a strong credit profile, a conservative capital stack and a low loan to value ratio. The senior loan is provided by a major bank and the developer has a significant amount of equity invested in the project. The EB-5 capital is the smallest portion of funds in the capital stack.

Justification: The credit quality of a project is a key indicator of its financial stability. A project with a strong credit profile is less likely to experience financial distress or default on its loans. The developer should have skin in the game, and the EB-5 capital should be the smallest portion of the funds used in the project.

7. What's the typical payback period?

Ideal Answer: Typical payback period for the project is five to seven years. The investment is structured as a loan with a five-year term. This aligns with the sustainment period required by USCIS. The project has a clear exit strategy in place to ensure the timely repayment of capital. The repayment timeline is outlined in offering documents.

Justification: The payback period of an EB-5 investment can vary depending on the project and the structure of the investment. A typical payback period is five to seven years. The investor should look for projects with a clear and realistic exit strategy and a track record of timely capital repayment.

8. If the project didn't have EB-5 funds how would they finance this?

Ideal Answer: The project is 80% financed through institutional senior debt and developer equity. EB-5 capital is replacing 20% mezzanine debt that would cost 12-15% annually. The developer has equity investment in the project that represents over 20% of the total capital stack.

Justification: EB-5 capital should fill a genuine financing gap and NOT be the project's lifeline. Projects that couldn't secure traditional financing are inherently riskier. EB-5 should be cheaper capital and not rescue capital. A significant amount of developer equity is a critical feature of a good EB-5 project. A lack of developer equity is a major red flag as it may indicate the developer is not fully committed to the project.

9. What is the EB-5 admin fee?

Ideal Answer: $65,000 to $70,000 total and covers the regional center fee, legal and admin costs. A transparent breakdown can be provided.

Justification: Industry standards are $65,000 to $80,000. Anything significantly higher suggests excessive fees. Anything suspiciously low may indicate hidden costs or underfunded compliance.

10. What is the expected financial return?

Ideal Answer: The expected financial return is 1-2% with principal protection prioritized through senior position and project equity cushion. The focus is capital preservation and ensuring the success of the investor's immigration petition. A low return and low risk investment is the most prudent approach for EB-5 investors because the green card and the return of capital is the best case.

Justification: EB-5 is immigration investment and not a financial investment. The ROI is the green card. Modest returns are standard. Higher promised returns may indicate excessive risk. The focus should be on capital preservation, not yield.

11. Who is the immigration lawyer?

Ideal Answer: We work with top tier firms who have handled 1000+ successful I-526 petitions with a 98% approval rate.

Justification: Immigration success is paramount. Top firms with extensive EB-5 experience, high approval rates and good USCIS relationships are essential. Avoid general practice attorneys. Investors should only work with 15+ years of experience in the EB-5 environment.

12. What is the exit strategy for the project?

Ideal Answer: The exit strategy for the project has multiple paths. The first and most ideal path is the refinancing of the project upon stabilization. The second potential exit is a sale to an institutional buyer.

Justification: A clear and credible exit strategy is a critical component of a good EB-5 project. It provides a roadmap for the repayment of the investor's capital. Avoid projects dependent solely on speculative sales or uncertain cash flows.

13. How much developer equity is in this project?

Ideal Answer: Developer has significant equity (25% of total capital stack) invested in the project, subordinated to EB-5 capital.

Justification: Significant developer equity invested in the project demonstrates a strong alignment of interest between the developer and the EB-5 investor. A lack of developer equity is a major red flag and may indicate that the developer is not fully committed to the project. Equity subordination to EB-5 capital provides critical downside protection. Ideally the EB-5 investor is in the first lien position.

14. What happens if an I-526 petition is denied?

Ideal Answer: If I-526 petition is denied full capital will be refunded within 90 days minus documented out of pocket legal fees. The investors capital is held in escrow until I-526 approval.

Justification: I-526 denial refund provisions are mandatory due diligence items for the EB-5 investor. Funds should be held in escrow until approval which protects the investor from capital loss. A clear and transparent refund policy is a critical component of a good EB-5 project.

15. Are there any conflicts of interest between the NCE and JCE?

Ideal Answer: The NCE and JCE are separate legal entities with independence governance. The regional center is independent of the developer. We have a robust set of policies and procedures in place to manage any potential conflicts of interest and ensure that the interests of our investors are protected.

Justification: Conflicts of interest create unnecessary risk for the investment. Independence, disclosure and independent oversight protect investor interests.

16. Has the regional center ever been investigated by the SEC?

Ideal Answer: No investigations, enforcement actions, or regulatory issues. Clean compliance history with annual audits are available for review for the EB-5 investor.

Justification: SEC investigations indicate potential securities violations, fraud or mismanagement. Clean regulatory history is essential. Request verification through records.

17. Does the project have an EB-5 repayment Guaranty?

Ideal Answer: The project includes a repayment guaranty from a well-capitalized and reputable company. The guarantor has a strong balance sheet and a proven track record of financial stability. The developer provides limited guaranty of EB-5 capital backed by $20M in assets and personal recourse provisions.

Justification: Guaranties add significant protection, especially when backed by substantial verifiable assets. Personal resources ensures developer accountability. Evaluate guarantor's creditworthiness thoroughly to assess their ability to fulfill their obligations.

18. Ask for a copy of the business plan.

The business plan is the EB-5 investors roadmap. The business plan should be detailed, professionally prepared and have realistic assumptions and expectations. This is nonnegotiable and never invest without thoroughly reviewing and understanding the business plan for the EB-5 project.

19. What is the EB-5 investor's lien position?

Ideal Answer: The EB-5 investor holds the first position for repayment. If the investment fails the EB-5 investor will be made whole.

Justification: Many projects will have the EB-5 investor subordinate to other capital sources in the capital stack. A subordinate position suggests the fund may prioritize other stakeholders over EB-5 investor protection which is a red flag when evaluating project safety.

---

Watch: EB-5 Deal Analysis Explained

---

Glossary

Guaranteed Maximum Price (GMP): A construction agreement that sets a ceiling on the amount an owner must pay the contractor. This creates a defined cost for the owner and eliminates chances of overrun costs.

Capital Stack: The sources of capital to fund an investment.

New Commercial Enterprise (NCE): For profit business entity created to receive EB-5 investor capital. Regional center forms an NCE and EB-5 investors subscribe as limited partners in the entity.

Job Creating Entity (JCE): The actual business or project that receives the EB-5 funds and creates the minimum required 10 full-time jobs.

EB-5 Repayment Guarantee: A third-party entity, guarantor, project developer or sponsor pledges to repay the EB-5 loan in case the borrower is unable to do so.

Lien Position: Determines the order in which investors/creditors get paid if the project defaults. First in line gets paid in full before second in line.

---

Schedule your free EB-5 consultation or subscribe for expert insights at [www.studenteb5.com](https://www.studenteb5.com)

References

• U.S. Citizenship and Immigration Services. (2023, March 1). [EB-5 Immigrant Investor Program](https://www.uscis.gov/working-in-the-united-states/permanent-workers/eb-5-immigrant-investor-program)

• U.S. Citizenship and Immigration Services. (n.d.). [About the EB-5 Visa Classification](https://www.uscis.gov/working-in-the-united-states/permanent-workers/employment-based-immigration-fifth-preference-eb-5/about-the-eb-5-visa-classification)

• U.S. Citizenship and Immigration Services. (n.d.). [EB-5 Immigrant Investor Process](https://www.uscis.gov/working-in-the-united-states/permanent-workers/employment-based-immigration-fifth-preference-eb-5/eb-5-immigrant-investor-process)

• U.S. Citizenship and Immigration Services. (n.d.). [EB-5 Questions and Answers](https://www.uscis.gov/working-in-the-united-states/permanent-workers/employment-based-immigration-fifth-preference-eb-5/eb-5-questions-and-answers)

The opinions expressed on this website are solely those of the author/presenter. The information provided is for general informational purposes only and should not be considered professional or legal advice. Student EB5 and its contributors do not endorse or take responsibility for any actions taken based on the information presented here. Visitors are strongly advised to consult with qualified immigration attorneys and financial advisors before making any EB-5 investment decisions or taking any actions based on the content on this website.